Since mid-November the total value locked (TVL) in decentralized finance (defi) has slid from $257 billion to $250.55 billion and during the last 24 hours it lost a touch more than 5%. Over the last seven days, defi tokens like uniswap, pancakeswap, curve dao token, 1inch and sushi have lost anywhere between 15% to 23.9% in value.

Defi TVL Drops — Curve, Makerdao and Convex Finance Dominate

At the time of writing, the TVL in defi protocols across a myriad of blockchains is $250.55 billion, according to metrics from defillama.com. The aggregate defi value locked has lost 5.08% during the last day, and the protocol Curve dominates most of the TVLs listed with 8.07% dominance.

The automated market maker (AMM) Curve commands $20.23 billion TVL which is up 1.13% this past week. Makerdao is the second-largest defi protocol TVL with $18.56 billion at the time of writing. The third-largest defi protocol TVL belongs to Convex Finance with $15.14 billion today.

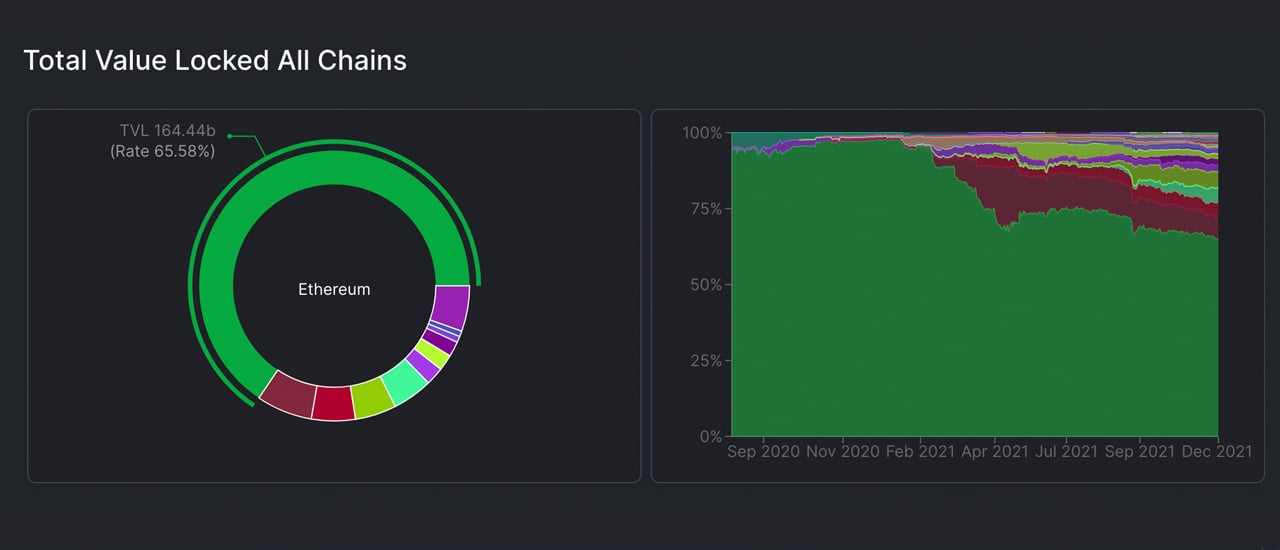

Ethereum Defi TVL Dominance 65%, Binance Smart Chain 6%, Terra 5%

TVL per blockchain shows that Ethereum commands $164.36 billion of the $250.55 billion in defi on Sunday. Binance Smart Chain (BSC) captures $16.61 billion and the chain is the second-largest chain in terms of defi protocol TVLs.

Following BSC is Terra ($13.29B), Avalanche ($12.03B), Solana ($12.46B), and Tron ($5.48B). At the time of writing, Ethereum commands 65.58% of the $250.55 billion of value locked in defi. While BSC commands 6.62% dominance, the TVL in Terra captures 5.30%.

Rebase and AMM Defi Tokens Slide —Crosschain Bridge TVL Slips 26% in 30 Days

Statistics from coingecko.com indicate that the total market capitalization of the top automated market maker (AMM) defi tokens has dropped 13.6% to $17.2 billion. Additionally, metrics show that rebase tokens have lost 5.1% to a low of $6.09 billion on Sunday.

The top AMM crypto asset uniswap (UNI) has shed 15% during the last seven days. Uniswap is followed by pancakeswap (16.7%), curve dao token (27.2), 1inch (26.3%), sushi (23.9%), and bancor token (10.1%).

Rebase tokens such as olympus (OHM) shed 17.1% this past week while wonderland (TIME) has lost 18.5%. Klima dao (KLIMA) is down 50.6% during the last seven days and ampleforth (AMPL) lost 17.7%.

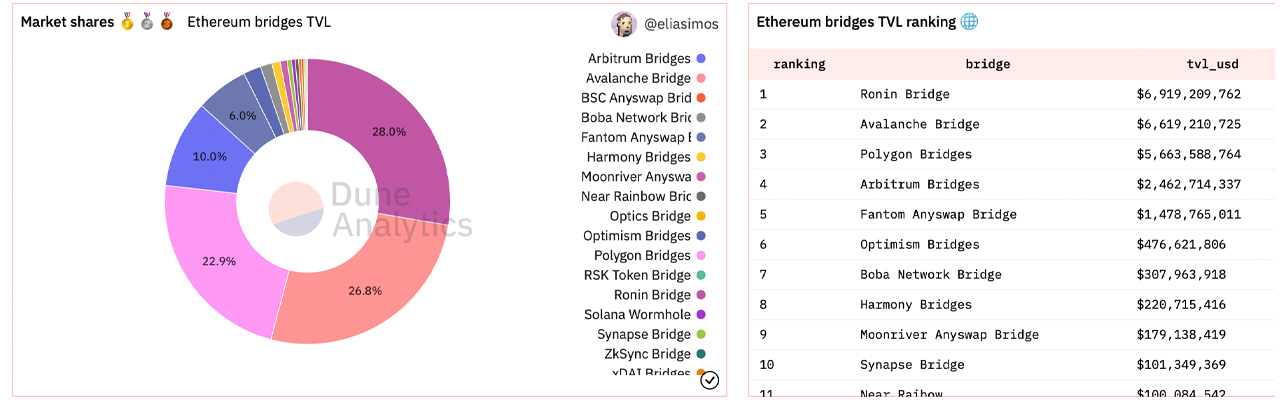

Monthly stats show cross-chain bridge TVLs have slipped 26.9% and today there’s $24.40 billion TVL in bridges to Ethereum, according to Dune Analytics. The leader is the Ronin bridge with $6.9 billion and Avalanche has $6.6 billion and Polygon has $5.6 billion.

What do you think about the state of decentralized finance (defi) today? Let us know what you think about this subject in the comments section below.

from Bitcoin News https://ift.tt/3doyrwo

https://ift.tt/31zMZGJ

0 Comments