Between 2011 and 2021, the share of the world’s adult population that had bank accounts rose from 51% to 76%, the findings of the latest World Bank Global Financial Index survey have shown. About 1.4 billion adults are, however, still unbanked, not having the money or the identification required for opening a bank account.

Mobile Money Narrows Financial Exclusion Gap in Sub-Saharan Africa

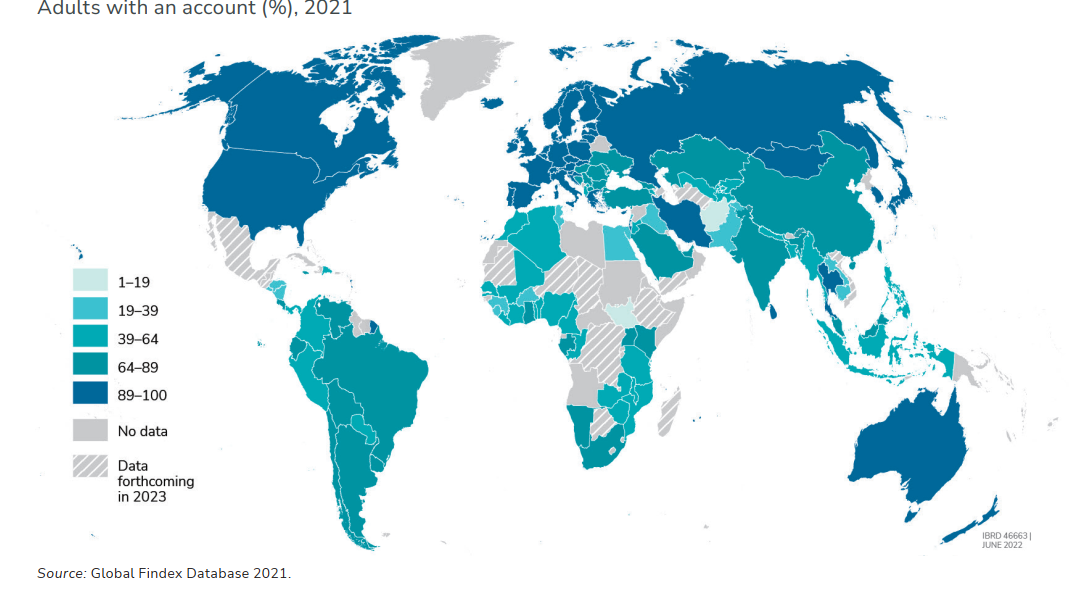

According to the findings of the 2021 Global Financial Index (Findex) survey, the percentage of the world’s adult population with a bank account is now 76%, a fifty percent increase from the 51% that was recorded in 2011. In developing economies, the average rate of account ownership rose by 8 percentage points from 63% to 71% in the period between 2017 and 2021.

While in the past it was China and India that accounted for most of the growth, the latest survey report notes that the “recent growth in account ownership has been widespread across dozens of developing economies.”

Concerning Sub-Saharan Africa, where a significant portion of unbanked adults is found, the survey findings show that “55 percent of adults had an account, including 33 percent of adults who had a mobile money account.” According to the survey, this is “the largest share of any region in the world and more than three times larger than the 10 percent global average of mobile money account ownership.”

The same region is also home to some 11 economies wherein a larger proportion of adults “only had a mobile money account rather than a bank or other financial institution account.” Besides helping adults without bank accounts, mobile money may have created opportunities to better serve marginalized groups, the survey report noted.

‘Enabling Infrastructure Has Important Role to Play’

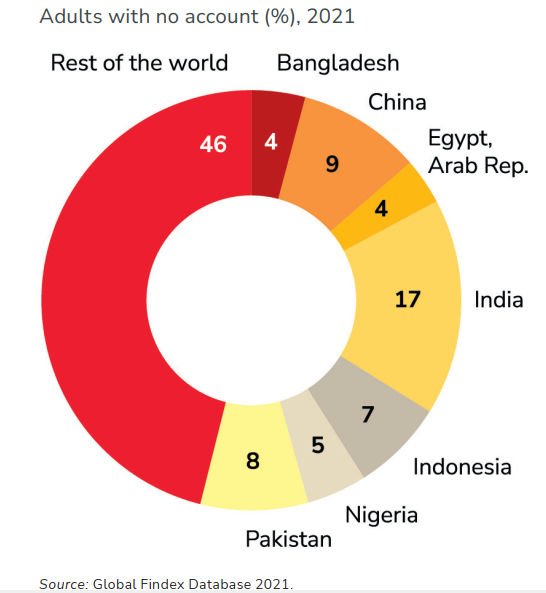

Yet despite the encouraging findings, the survey study still found that as many as 1.4 billion of the world’s adult population are still unbanked. Reasons given for this state of affairs range from a lack of money, the distance to the nearest financial institution, and the lack of the identification documents needed to open an account.

However, barriers preventing hundreds of millions of adults from opening bank accounts can be overcome once the enabling infrastructure becomes available, the survey report concludes.

“Enabling infrastructure has an important role to play. For example, global efforts to increase inclusive access to trusted identification systems and mobile phones could be leveraged to increase account ownership for hard-to-reach populations,” a summary of the survey report states.

In addition, the summary asserts that the “chief actors” in any efforts aimed at further reducing the number of unbanked adults “must also invest in regulations and governance to ensure that safe, affordable, and convenient products and functionality are available and accessible to all adults in their economies.”

The survey report concluded, just as many other reports and studies have previously, that the outbreak of the Covid-19 pandemic helped to spur the growth in adoption and use of digital payments. To support this assertion, the report points to India, where human movement restrictions forced more than 80 million adults to make a digital merchant payment for the first time. The trend seems to follow for other developing economies as well. Excluding China, “20 percent of adults [in developing economies] made a digital merchant payment in 2021.”

Register your email here to get a weekly update on African news sent to your inbox:

What are your thoughts on the findings of the latest Global Findex survey? Let us know what you think in the comments section below.

from Bitcoin News https://ift.tt/fZOrTCV

https://ift.tt/TLWBm8A

0 Comments