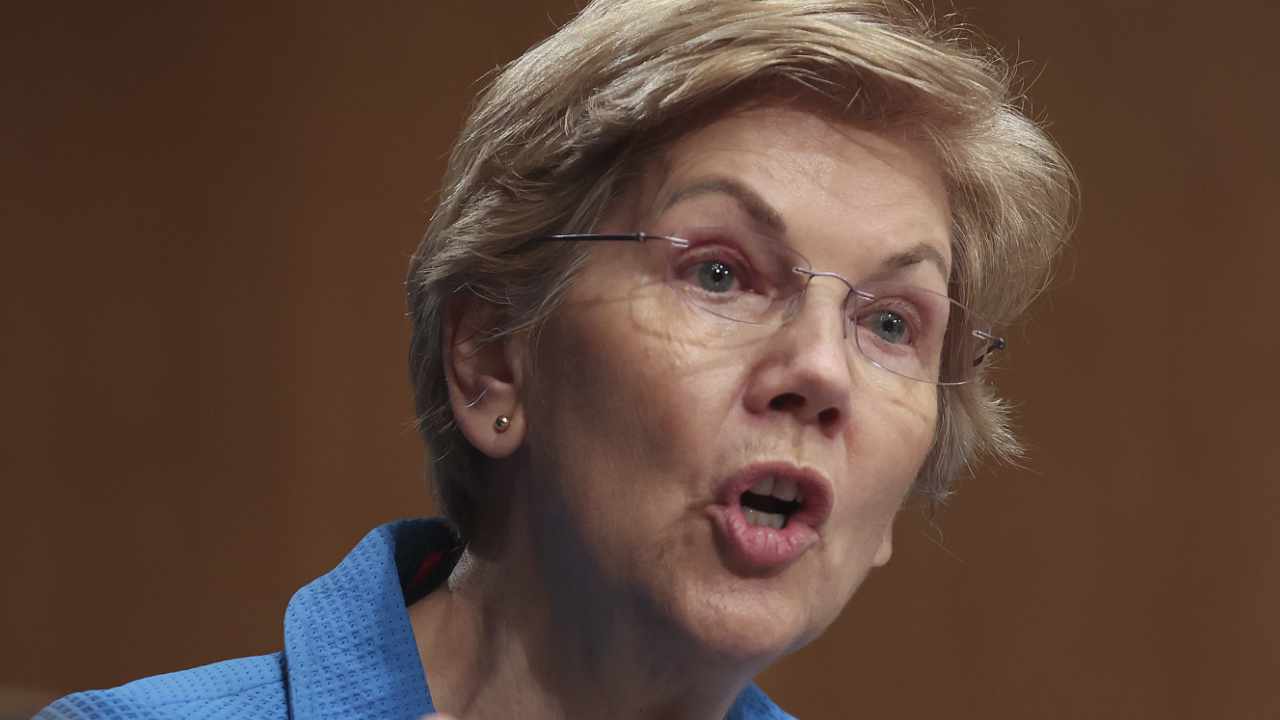

U.S. Senator Elizabeth Warren says that “too many crypto firms have been able to scam customers and leave ordinary investors holding the bag while insiders make off with their money.” She stressed the need for stronger rules, urging the Securities and Exchange Commission (SEC) and Congress to take action on crypto regulation.

U.S. Senator Says Crypto Needs Stronger Regulation

U.S. Senator Elizabeth Warren (D-MA) voiced her concerns about cryptocurrency investing in an interview with Yahoo Finance Live last week after several crypto firms filed for bankruptcy protection.

Calling on the U.S. Securities and Exchange Commission (SEC) to act, she emphasized:

Congress needs to act, but the SEC has a responsibility to use its authorities to put guardrails in place and crack down on crypto actors that break the rules.

“I’ve been ringing the alarm bell on crypto and the need for stronger rules to protect consumers and financial stability,” the senator added.

Last week, crypto lender Celsius Network filed for bankruptcy protection after freezing withdrawals. A week prior, another crypto lender, Voyager Digital, filed for bankruptcy protection. The company cited contagion in crypto markets and bankrupt crypto hedge fund Three Arrows Capital‘s loan default as the reasons.

Warren stressed:

Too many crypto firms have been able to scam customers and leave ordinary investors holding the bag while insiders make off with their money.

SEC Commissioner Hester Peirce expressed concerns in May that the securities watchdog has dropped the ball on the regulation of cryptocurrencies. “We can go after fraud and we can play a more positive role on the innovation side, but we have to get to it, we’ve got to get working … I haven’t seen us willing to do that work so far,” she opined.

Gary Gensler, the chairman of the SEC, has been criticized for taking an enforcement-centric approach to crypto regulation. In May, the securities watchdog said it will almost double the size of its enforcement division’s crypto unit. Last week, Gensler outlined what investors can expect from the SEC on the crypto regulatory front.

Senator Warren has been pressing Gensler to step up crypto oversight on several occasions. In July last year, she warned of the growing risks of cryptocurrency trading, calling on the securities regulator to “use its full authority to address these risks.” She also said decentralized finance (defi) is the most dangerous part of crypto, urging regulators to clamp down on stablecoins and defi platforms “before it is too late.”

In May, she demanded answers from financial services firm Fidelity Investments regarding the company’s decision to allow bitcoin investments in 401K plans. Fidelity’s move has troubled the Labor Department. “We have grave concerns with what Fidelity has done,” said Ali Khawar, Acting Assistant Secretary of the Labor Department’s Employee Benefits Security Administration. The senator has also repeatedly bashed bitcoin’s environmental impact.

What do you think about the comments by U.S. Senator Elizabeth Warren? Let us know in the comments section below.

from Bitcoin News https://ift.tt/nykK6It

https://ift.tt/0HStlaq

0 Comments