Residents of the United States, South Korea and the Russian Federation have been the most frequent users of centralized exchanges this year, according to a new study. The finding comes after the spectacular crash of FTX, one of the largest such platforms, amid tightening regulations and fewer new users.

U.S. Leads by Number of CEX Users, Turkey and Japan Are Also in the Top in Terms of Traffic

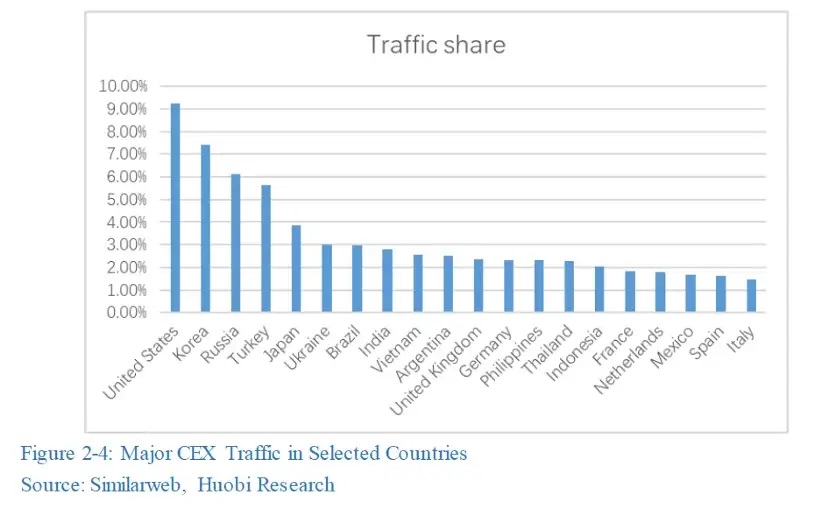

The U.S., South Korea and Russia together account for 22% of all visits to centralized exchanges (CEX) for cryptocurrencies, according to the 2022-2023 “Global Crypto Industry Overview and Trends” annual report produced by Huobi Research. The estimate is based on data from the top 100 CEXs on active users, trading depth, trading volume, and reliability.

With a share exceeding 9%, the United States is the pronounced leader in terms of absolute number of crypto users generating CEX traffic. South Korea, Russia, Turkey, and Japan are next with 7.4%, 6.1%, 5.6% and 3.8%, respectively.

The drivers are different in each case – from high unemployment and housing prices turning young people in South Korea and Japan towards crypto investments, to Western sanctions for Russians and hyperinflation for Turks.

The authors insist that “centralized exchanges are vital in the cryptocurrency market. These exchanges are usually user friendly and many crypto novices start with them.” They also point out that most of the users and liquidity in the crypto market are aggregated in centralized exchanges.

However, the findings come in the aftermath of the crash of FTX, one of the largest CEXs which filed for bankruptcy protection on Nov. 11 amid liquidity issues. The researchers call it “the incident of the year since entering the current bear market” and note it is part of a series, also including the collapse of Terra and the bankruptcy of 3AC.

The study further reveals that the overall market size of CEXs declined more significantly in 2022 in comparison with the previous year. The number of unique visitors decreased by 24%. “The continuous gloomy market condition and the depreciating assets are both depressing existing users,” the report elaborates. At the same time, new user growth declined to 25 million from 194 million in 2021.

Regulations for Centralized Exchanges Tighten in Key Jurisdictions Around the World

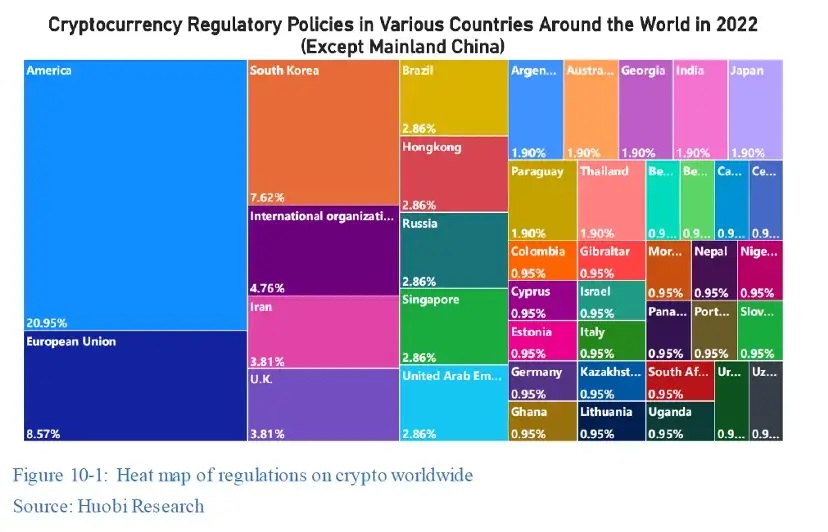

Huobi Research also notes that regulations on centralized cryptocurrency exchanges are tightening globally after the FTX bankruptcy, including for on-chain activities, and that regulators may oblige CEXs to publicize proof of funds or require that they maintain an amount of funds in reserve.

This year, U.S. president Biden signed an Executive Order on Ensuring Responsible Development of Digital Assets, the EU approved its Markets in Crypto Assets (MiCA) legislation, Russia has been working to expand its legal framework for crypto, and South Korea passed eight related regulations.

Against this backdrop, decentralized finance (defi) has become one of the crypto markets with skyrocketing growth, the author’s highlight. Despite a series of unfavorable incidents in that sector as well, the more experienced defi users remain confident about the recovery and the long-term value of defi.

With almost 32% of the traffic, the U.S. also has the largest share in this segment. Brasil is second, with a little over 5%, followed by several developed countries, unlike the CEX market, namely the U.K., France, Canada, and Germany, which are seeing significant defi traffic.

Do you think centralized exchanges will continue to play a key role as entry points to the crypto space for novice users? Share your thoughts on the subject in the comments section below.

from Bitcoin News https://ift.tt/cJrIpt2

https://ift.tt/uCmi5JB

0 Comments