Larry Fink, the CEO of the world’s largest asset manager, Blackrock, sees the recent bitcoin rally as “an example of the pent-up interest in crypto.” Noting that as the Israel-Hamas war rages on, more people will be running to bitcoin as “a flight to quality,” the executive emphasized: “We are hearing from clients around the world about the need for crypto.”

‘The Rally Today Is About a Flight to Quality’

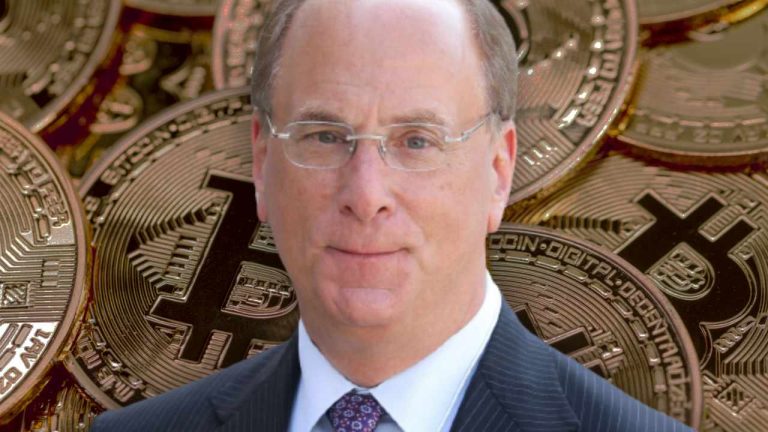

Blackrock CEO Larry Fink offered his perspective on the bitcoin rally Monday following a rumor that the U.S. Securities and Exchange Commission (SEC) had approved his company’s spot bitcoin exchange-traded fund (ETF) application.

While emphasizing that he cannot discuss “the specifics of anything,” Fink said on Fox Business:

I think it’s just an example of the pent-up interest in crypto. We are hearing from clients around the world about the need for crypto.

The rumor was spread by crypto news outlet Cointelegraph which posted on social media platform X early Monday morning that the SEC had approved Blackrock’s spot bitcoin ETF. The news outlet later retracted the story. Bitcoin spiked nearly 10% before dropping back to the $28,000 level after the fake news report.

Noting that “Some of this rally is way beyond the rumor,” the Blackrock CEO stressed:

I think the rally today is about a flight to quality, with all the issues around the Israeli war now, [and] global terrorism. And I think there’s more people running to a flight to quality — whether that is in Treasurys, gold, or crypto, depending on how you think about it.

Blackrock filed an application for Ishares Bitcoin Trust, a spot bitcoin ETF, with the SEC in June. If approved by the SEC, the trust will use Coinbase Custody as its custodian. In July, Fink said crypto will transcend any one currency.

A growing number of financial institutions have filed for approval to launch spot bitcoin ETFs with the SEC. However, none have been approved. Last month, several U.S. lawmakers urged the SEC to immediately approve spot bitcoin ETF applications. Steven Schoenfeld, former head of International Equity Product Strategy at Barclays Global Investors expects the SEC to approve all bitcoin ETF applications within three to six months. On Friday, the deadline for the SEC to appeal the circuit court decision regarding Grayscale Investments’ application to convert its bitcoin trust (GBTC) to a spot bitcoin ETF expired without the SEC appealing.

What do you think about the statements by Blackrock CEO Larry Fink? Let us know in the comments section below.

from Bitcoin News https://ift.tt/MF8fk3Q

https://ift.tt/afdbFy3

0 Comments